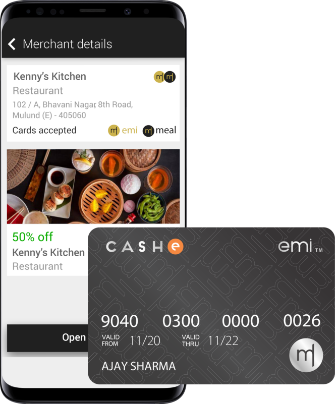

Enjoy pre-approved credit for all your purchases at any Mswipe merchant. Pay back in easy instalments with low interest rates.

Pre-approved credit limit, for every kind of expense, both planned and unplanned

Avail offers on a wide range of goods and pay back in easy loan instalments for all your purchases

Free lifetime membership No annual or additional charges

NBFC EMI card is especially handy when you need access to credit the most

Shop at your favorite stores, dine out, travel and stay at exotic locations or cover emergency expenses. Buy online and pay in easy instalments with Mcards on major online shopping sites.

Meet your financial needs with ease

Your card is linked

to

a credit limit provided by one of our partners. Make a purchase

and pay in easy loan instalments.

Discover the best offers and discounts on products and services across retail, dining, electronics, consumer appliances, health & wellness, travel and much more exclusively for Mcards members.

With the Mcards app, monitor monthly spends and instalments, view statements and account details. You can easily keep track of your cards, manage multiple card PINs and even block lost cards!