What are digital payments?

Digital payments can be defined as the payment done through digital or

electronic mediums with the use of the internet and payment received in the same

way.

India is generally perceived as a cash based economy but gradually the perception is changing. The percentage of smartphone penetration and internet usage is growing exponentially every year in India. This has boosted the digital payment landscape in the country. Anyone from anywhere can easily make payment to buy products and avail services. Also, the goal of digital transformation took a giant leap with the Digital India initiative taken by the government of India a few years back. Faceless, Paperless and Cashless is the aim of the present government. Over the last several years, infrastructure investment along with a focused approach is being made consistently to include people from all sections of society and thus achieve financial inclusion.

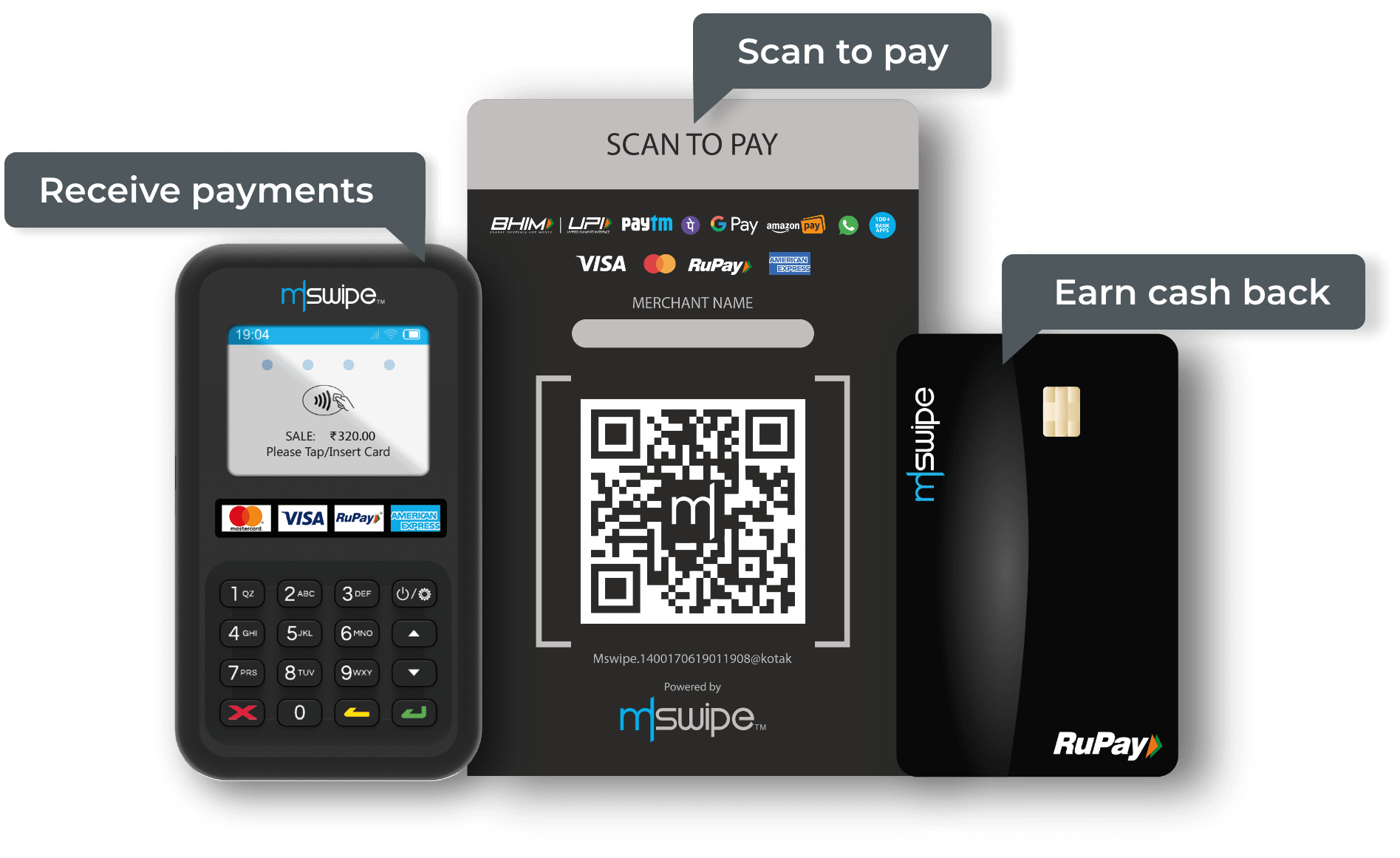

What about companies? Various businesses across the country have started to accept payments online and others are ready to embrace it. There are many devices, POS terminals, QR-based payment, mobile wallet, EMI card, UPI, internet banking, mobile banking and many other forms of payment methods which are helping in making this transition towards a digital economy. It makes it easy for the retailers and shops to manage transactions, keep reports and maintain the accounts with the digital mode of payments, especially with POS terminals. Even the SMEs which constitute the majority of business in India have started to use POS terminals and guess what consumers are now inclined to use it.

Be it restaurants, hotels, travel, home delivery of products etc, consumers find it a hassle free experience to pay via the digital medium. Those online shopping stores which accept payments online, consumers are preferring them over the others. The unprecedented situation due to Coronavirus has once again brought digital payments to the centre stage. People not only in India but across the globe now prefer digital payments than payment through currency notes. The advancement of financial technology in the recent past has led to the development of various useful digital tools and devices which makes payment safe and easy.

With all the stakeholders like consumers, businesses and the government pushing for a cashless economy today, digital payments are indeed the future and rightly so.

India is generally perceived as a cash based economy but gradually the perception is changing. The percentage of smartphone penetration and internet usage is growing exponentially every year in India. This has boosted the digital payment landscape in the country. Anyone from anywhere can easily make payment to buy products and avail services. Also, the goal of digital transformation took a giant leap with the Digital India initiative taken by the government of India a few years back. Faceless, Paperless and Cashless is the aim of the present government. Over the last several years, infrastructure investment along with a focused approach is being made consistently to include people from all sections of society and thus achieve financial inclusion.

What about companies? Various businesses across the country have started to accept payments online and others are ready to embrace it. There are many devices, POS terminals, QR-based payment, mobile wallet, EMI card, UPI, internet banking, mobile banking and many other forms of payment methods which are helping in making this transition towards a digital economy. It makes it easy for the retailers and shops to manage transactions, keep reports and maintain the accounts with the digital mode of payments, especially with POS terminals. Even the SMEs which constitute the majority of business in India have started to use POS terminals and guess what consumers are now inclined to use it.

Be it restaurants, hotels, travel, home delivery of products etc, consumers find it a hassle free experience to pay via the digital medium. Those online shopping stores which accept payments online, consumers are preferring them over the others. The unprecedented situation due to Coronavirus has once again brought digital payments to the centre stage. People not only in India but across the globe now prefer digital payments than payment through currency notes. The advancement of financial technology in the recent past has led to the development of various useful digital tools and devices which makes payment safe and easy.

With all the stakeholders like consumers, businesses and the government pushing for a cashless economy today, digital payments are indeed the future and rightly so.

How does the digital payment system work?

Digital payment system constitutes of consumer, merchant, bank and the payment

network. The consumer is the one who uses a credit card or debit card to make

the payment. Merchant is the service provider or the one from whom a consumer

buys a product. It can be a store as well. Banks issue the cards to the consumer

and are usually at play when a digital transaction is done as an issuer. It is

the source of money for the merchants as well. The last participant in the

system is the payment network like VISA or MasterCard which are popular and

dominant networks in the whole world. You might have heard about RuPay. It is

India’s own payment network.

To begin with, one must have a bank account with internet banking enabled. The usage of the cheque has greatly reduced and replaced it with online banking. The bank payment options include NEFT, RTGS or IMPS which are used by businesses to do transactions, give salary to employees, help near and dear ones. Similarly, the person or entity on the other end must have an online banking facility to receive the payment. This was about the very basic and common digital payments and how it works.

To begin with, one must have a bank account with internet banking enabled. The usage of the cheque has greatly reduced and replaced it with online banking. The bank payment options include NEFT, RTGS or IMPS which are used by businesses to do transactions, give salary to employees, help near and dear ones. Similarly, the person or entity on the other end must have an online banking facility to receive the payment. This was about the very basic and common digital payments and how it works.

Latest Trends in the Digital Payment Industry

Now, there are various non-traditional players who are redefining the digital

payment landscape. These companies are neither banks nor payment networks. They

can not be seen as merchants as well. They are far more complex and therefore

let’s just say that they are only focused on making digital payments easy and

accessible for everyone. Dedicated POS devices which accept all modes of

cashless and contactless payments are some of their major inventions. More on

that later.

The payment technology has made transactions much more easier. Credit cards and debit cards have always made payments easy. We all know how it works. The card is inserted into a payment reader device where a PIN number is used to make the payment. This has now evolved into new forms with digital payments. There are QR-based payment systems where smartphones are used to scan the QR code and payment is done instantly.

In the business sphere, POS terminals are leading the digital payments. It helps the merchants to conduct transactions and maintain accounts and other things. Similarly, it is easy for the consumer to engage in fast, secure and safe payment transactions which mean no more ques and faster checkout at shopping malls and elsewhere. Just a swipe or tap and the transaction is done.

Contactless payment methods enabled by NFC technology is the latest buzzword. It is transforming the payment industry as a whole. The POS terminal with NFC option and a card with NFC helps in making payments without any need for contact or touch. Accepting payment online is possible and feasible with a faster payment infrastructure system and contactless payment does exactly that.

The e-commerce boom has opened a world of opportunities and possibilities in digital payment growth. Including discounts, offers, and EMI plans is simple and easy. The launch of EMI card from Mswipe which is a pre-approved loan credit is a game- changer as far as payment methods are concerned. Other types of digital payments in India include Aadhar enabled payment system - AEPS, UPI, Bharat Interface or BHIM, mobile wallets.

The payment technology has made transactions much more easier. Credit cards and debit cards have always made payments easy. We all know how it works. The card is inserted into a payment reader device where a PIN number is used to make the payment. This has now evolved into new forms with digital payments. There are QR-based payment systems where smartphones are used to scan the QR code and payment is done instantly.

In the business sphere, POS terminals are leading the digital payments. It helps the merchants to conduct transactions and maintain accounts and other things. Similarly, it is easy for the consumer to engage in fast, secure and safe payment transactions which mean no more ques and faster checkout at shopping malls and elsewhere. Just a swipe or tap and the transaction is done.

Contactless payment methods enabled by NFC technology is the latest buzzword. It is transforming the payment industry as a whole. The POS terminal with NFC option and a card with NFC helps in making payments without any need for contact or touch. Accepting payment online is possible and feasible with a faster payment infrastructure system and contactless payment does exactly that.

The e-commerce boom has opened a world of opportunities and possibilities in digital payment growth. Including discounts, offers, and EMI plans is simple and easy. The launch of EMI card from Mswipe which is a pre-approved loan credit is a game- changer as far as payment methods are concerned. Other types of digital payments in India include Aadhar enabled payment system - AEPS, UPI, Bharat Interface or BHIM, mobile wallets.

Advantages

Fast payment option - One of the major benefits of digital payment is the speed

with which payment process is carried out. No need to fill extra information, no

waiting line to withdraw cash from ATMs are some other advantages. Also, you can

use digital payments 24X7 and 365 days.

Economical - There are various services which greatly reduce the additional charges and extra hidden fees. Take for instance the EMI card from Mswipe. There is no additional cost of using the card. Thus, the digital mode of payment and accepting payment online is more economical.

Discounts & Cash backs - The digital payment via apps and cards offer attractive discounts, cash backs, rewards and much more.

Bill payments - One can easily pay the utility bills like electricity, phone, Wi-Fi etc using digital modes of payment. Almost all such institutions are accepting online payment as well.

Mswipe is one of the leading POS service providers helping millions of SMEs in India with easy digital payment technology and advanced devices. You can find a wide range of POS devices which can simplify digital payments for you. Visit here for more information.

Economical - There are various services which greatly reduce the additional charges and extra hidden fees. Take for instance the EMI card from Mswipe. There is no additional cost of using the card. Thus, the digital mode of payment and accepting payment online is more economical.

Discounts & Cash backs - The digital payment via apps and cards offer attractive discounts, cash backs, rewards and much more.

Bill payments - One can easily pay the utility bills like electricity, phone, Wi-Fi etc using digital modes of payment. Almost all such institutions are accepting online payment as well.

Mswipe is one of the leading POS service providers helping millions of SMEs in India with easy digital payment technology and advanced devices. You can find a wide range of POS devices which can simplify digital payments for you. Visit here for more information.