The e-commerce boom has been one of the major factors which have developed the impulsive buying behaviour in common people. The endless opportunity to shop anytime, anywhere through the digital world and digital modes of payment has made it so easy. Some time ago, discounts and offers ruled the roost during festive season and times of extravagant events. All the big e-commerce players like Flipkart, Amazon, Myntra and others offer EMI options. But now it has become an everyday thing.

The most popular items which are bought on EMI are mobile phones, apparel, laptops, TV, fridge. Well, who can take eyes off the latest smartphones and who doesn’t want to replace the latest with the old? But today it is within your reach anytime and everywhere on the web. Although many of the services and payment methods offered are genuine and helpful, others are not so much.

A no cost EMI, as promised by banks and retailers, can be defined as a plan offered where you can pay for any product in installments every month with zero interest. But there is a caveat according to various finance experts.

So, what does RBI - Reserve Bank of India say about the no cost EMI?

According to a circular released by RBI in 2013, it has clearly mentioned that zero percent interest or no cost EMI is non-existent. Here is the complete statement released which says the following:-

“In the zero percent EMI schemes offered on credit card outstandings, the interest element is often camouflaged and passed on to the customer in the form of processing fee. Similarly, some banks were loading the expenses incurred in sourcing the loan (viz DSA commission) in the applicable rate of interest (RoI) charged on the product. Since the very concept of zero percent interest is non-existent and fair practice demands that the processing charge and RoI charged should be kept uniform product/segment wise, irrespective of the sourcing channel, such schemes only serve the purpose of alluring and exploiting the vulnerable customers. The only factor that can justify differential RoI for the same product, tenor being the same, is the risk rating of the customer, which may not be applicable in case of retail products where the RoI is generally kept flat and is indifferent to the customer risk profile."

(Source:What is the actual cost of 'No-cost EMI' you pay?)

As you can see the RBI has used choicest words to describe how no cost EMI can never be actually no cost. Let’s see how different companies and banks use this as a marketing gimmick to appeal to the customers.

Let’s assume you are buying X smartphone of Rs. 15,000. The retailers would show the price as Rs 15,000 and the discount of Rs. 2250. On further enquiring you would realize that the interest needs to be paid is Rs. 2250. As you can see, the discount rate is equal to the interest amount.

There is another way this no cost EMI works. In this method, your X smartphone will have the price of Rs. 17,250. The offer of no cost EMI will be offered to you. As you can see the interest amount is already added to the price of the product.

Also, there are down payment, processing fees and extra charges that often are under the wrap as far as the customer is concerned. Therefore, reading terms and conditions is a must. Be wise and understand the terms first before opting for no cost EMI plans

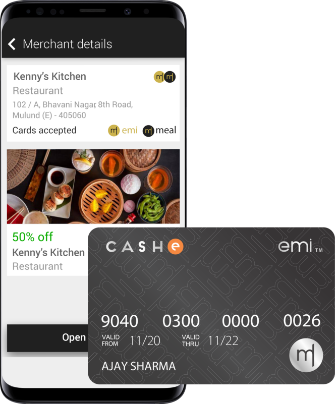

Enjoy pre-approved credit for all your purchases at any Mswipe merchant. Pay back in easy instalments with low interest rates.

Pre-approved credit limit, for every kind of expense, both planned and unplanned

Avail offers on a wide range of goods and pay back in easy loan instalments for all your purchases

Free lifetime membership No annual or additional charges

NBFC EMI card is especially handy when you need access to credit the most