Transactions throughout the last decade or two have grown in leaps and bounds.

In the 1960s, magstripe cards came into existence and people found it easy and

simple to use a plastic card for transactions. For the next four decades,

various kinds of cards offering discounts and offers came into being.

Contactless was around since the 1990s but did not gain much attention across

the world. By the year 2000 and late 2000, digital payment came into existence.

Internet banking, NEFT/RTGS transactions became prevalent among businesses and

common people.

Today the payment landscape has evolved again with the advancement in the latest financial technology which has resulted in amazing devices like POS terminals, mobile banking, QR code payments and whatnot. Contactless payment is one of the best modes of payment yet developed

Today the payment landscape has evolved again with the advancement in the latest financial technology which has resulted in amazing devices like POS terminals, mobile banking, QR code payments and whatnot. Contactless payment is one of the best modes of payment yet developed

What is Contactless Payments?

Contactless payments as the name indicates is the mode of payment where the

buyer does not need to come in contact with currency notes, devices or even the

smartphone. Acknowledging the need for such payment methods, today, it is

undoubtedly, one of the fastest growing payment methods across the globe. The

Covid-19 pandemic along with social distancing measures, health and hygiene

concerns have played a huge role in its growth recently and will further push

its use. It has turned out to be the most convenient form of payment modes as

well.

How does Contactless Payment Works?

Near field communication commonly known as NFC is the technology based on which

contactless payments work. It is an upgraded version of the existing technology

known as RFID - Radio Frequency Identification. RFID has been in use for a long

time for different applications like shopping malls, warehouses, bags etc which

can be scanned. It is only recently that RFID started to be used for contactless

payments. The two components - reader or POS terminal and the consumer’s payment

device have to be in close proximity for it to work successfully. The radio

waves from NFC chip establishes a connection and exchanges encrypted data making

the transactions fast and secure. A card or smartphone enabled with NFC can be

used near the reader, usually 10 cm or less to make the payment or conduct

transaction. This leads to the next section which is about contactless payment

cards.

What is a contactless payment card?

There are credit cards and debit cards which are enabled with NFC technology.

You might have seen many people just waving their card over a reader device to

make the payments. Such cards are known as contactless payment cards as it helps

the customer to do transactions without the need to touch any device.

Are contactless payments secure?

Contactless payments are inherently safe to use as they generate a unique code

for each and every transaction made. The standard encryption technology is used

to identify each transaction. This makes it difficult for hackers to hack as

transaction data is unique and can not be used elsewhere. At the authentication

level, the issuer can easily detect if the same data has been used for different

transactions and can reject authorization.

In contactless payments, transactions and the data are shared over radio waves and not through the chip in the card or magnetic stripe. Also, additional security measures are taken to make it secure which differs for different companies. For example, confidentiality is possible with many cards or services where cardholder name is not required to conduct transactions. Similarly, the consumer has control over the transaction as they do not need to share any information or give the card to the concerned at the shopping counter or elsewhere.

Unlike most other payment technologies which ask for inserting, swiping or tapping the card into a device, contactless payment is indeed contactless and therefore more effective and secure to use.

In contactless payments, transactions and the data are shared over radio waves and not through the chip in the card or magnetic stripe. Also, additional security measures are taken to make it secure which differs for different companies. For example, confidentiality is possible with many cards or services where cardholder name is not required to conduct transactions. Similarly, the consumer has control over the transaction as they do not need to share any information or give the card to the concerned at the shopping counter or elsewhere.

Unlike most other payment technologies which ask for inserting, swiping or tapping the card into a device, contactless payment is indeed contactless and therefore more effective and secure to use.

Benefits of Using Contactless Payments

Fast Transactions - The speed in which transactions can be completed using

contactless payments is simply incredible. It might take just 10 - 15 seconds to

be done with payment and out of the shop. Ques can become a thing of the past if

the retailers and customers embrace this technology. When compared to other

modes of payment, it is quite hassle-free and easy.

Secure - As mentioned before, contactless payments are a safe and secure mode of transactions. It is a great relief for consumers because there is an increase in the cases of fraud and cyber theft in recent years. It may seem that losing the card can increase the chances of losing money higher but it doesn’t need to be so. You can contact your card-issuer to freeze the account. Also, the amount spent is limited right now which will prevent larger spends.

Excellent consumer experience - This makes life all the more easier for consumers. Due to long queues and waiting time, people discard the cart leading to losses. With contactless payments, faster checkout is possible. This is indeed a win-win situation for consumers as well as retailers.

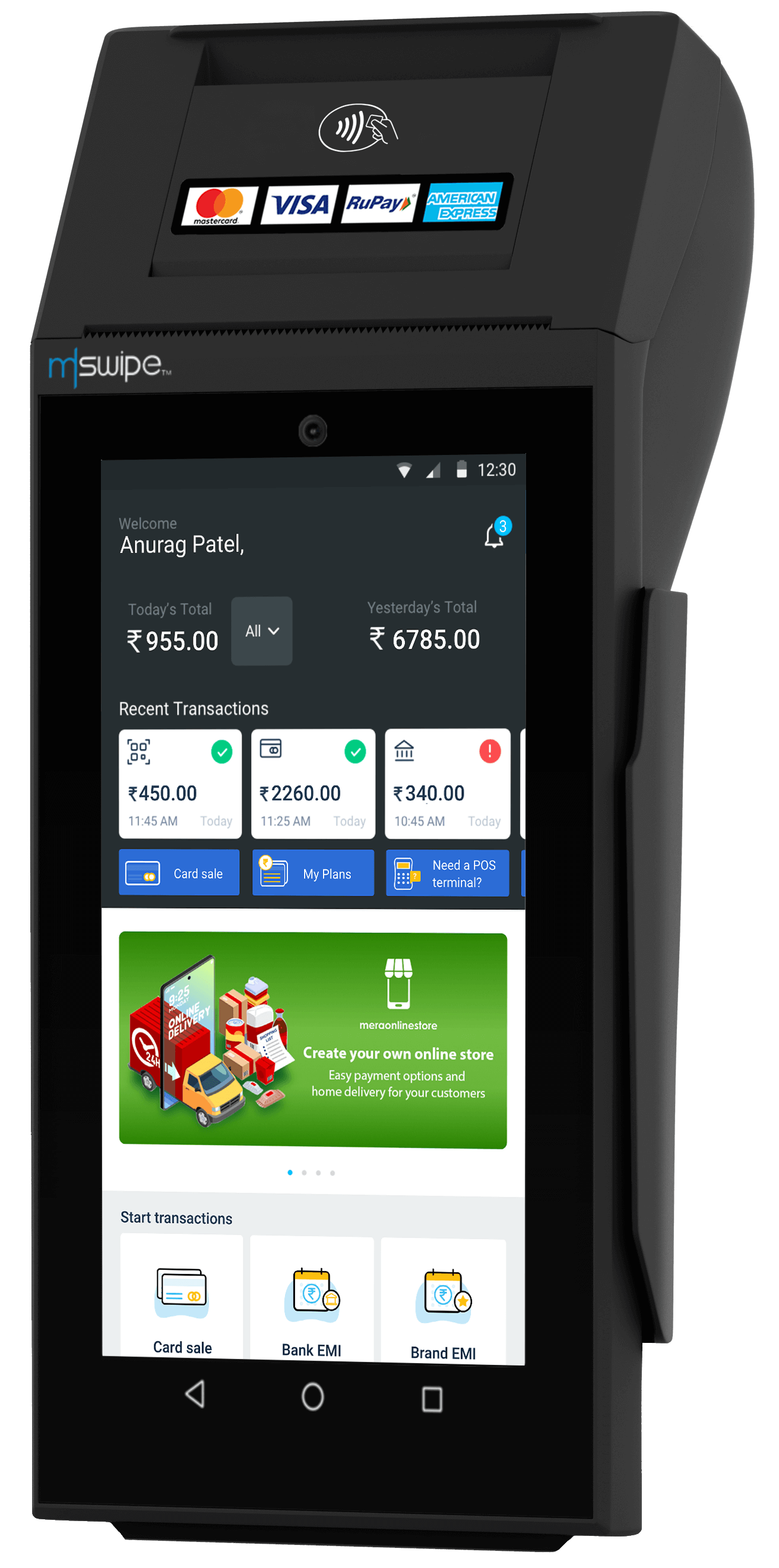

Mswipe is an industry leader in the payments field with POS solutions for all types of payment acceptance. The Wisepos range of POS devices accepts NFC cards and it is used by countless number of businesses across India. With the lingering Covid-19 situation, the team at Mswipe has made extra efforts to train safety and health measures to be taken by merchants while using tap and pay options with POS devices. Visit here for more information.

Secure - As mentioned before, contactless payments are a safe and secure mode of transactions. It is a great relief for consumers because there is an increase in the cases of fraud and cyber theft in recent years. It may seem that losing the card can increase the chances of losing money higher but it doesn’t need to be so. You can contact your card-issuer to freeze the account. Also, the amount spent is limited right now which will prevent larger spends.

Excellent consumer experience - This makes life all the more easier for consumers. Due to long queues and waiting time, people discard the cart leading to losses. With contactless payments, faster checkout is possible. This is indeed a win-win situation for consumers as well as retailers.

Mswipe is an industry leader in the payments field with POS solutions for all types of payment acceptance. The Wisepos range of POS devices accepts NFC cards and it is used by countless number of businesses across India. With the lingering Covid-19 situation, the team at Mswipe has made extra efforts to train safety and health measures to be taken by merchants while using tap and pay options with POS devices. Visit here for more information.